Jan 15, 2026

Stablecoin

Enabling the Next Billion with Stablecoins

Stablecoins aren’t the product, they’re the rail, and now they finally have the network to scale

Benjamin Fernandes

Rafiki was born from a mission to improve the reliability, speed and accessibility of cross-border payments within Africa. In the eighteen months since launching, we have built payment rails across 18 markets in Africa and Asia (and expanding quickly!), enabling payment providers and incumbents to better deliver money to individuals and businesses.

As our CEO and Founder says below, “We didn’t build Rafiki to be another payments API”, and in order to differentiate ourselves and reach the next stage of growth, we wanted to look beyond market expansion. As experts in the payments industry, we’ve been following the buzz about stablecoins building over the last five years, from a new but unexplored technology to the tangible payments infrastructure it has become.

The Stablecoins Market

In 2025, we began to explore what stablecoins could mean for our business and our clients. Could stablecoins serve to send money faster, or was there enough interest for our clients to collect and settle in stablecoins?

The stablecoin market was booming in 2025:

Stablecoins were processing nearly $1 trillion in monthly transaction volume by the end of 2025

Stablecoin usage expanded by 70% in 2025 alone

90% of banks and fintechs now support stablecoin rails in some capacity

In order to deliver on our mission to improve cross-border transactions within emerging markets, the opportunities presented by stablecoins are too huge to pass up. Not only are they building as a currency, but they provide the infrastructure for 24/7 settlement, lower FX friction and fewer barriers to entry.

The question remained: how can Rafiki, and by extension our customers, benefit from stablecoins without a complete technology overhaul?

Noah and NALA 🤝

A new generation of cross-border payment infrastructure is required to meet the demands of transaction volume, powered by stablecoins.

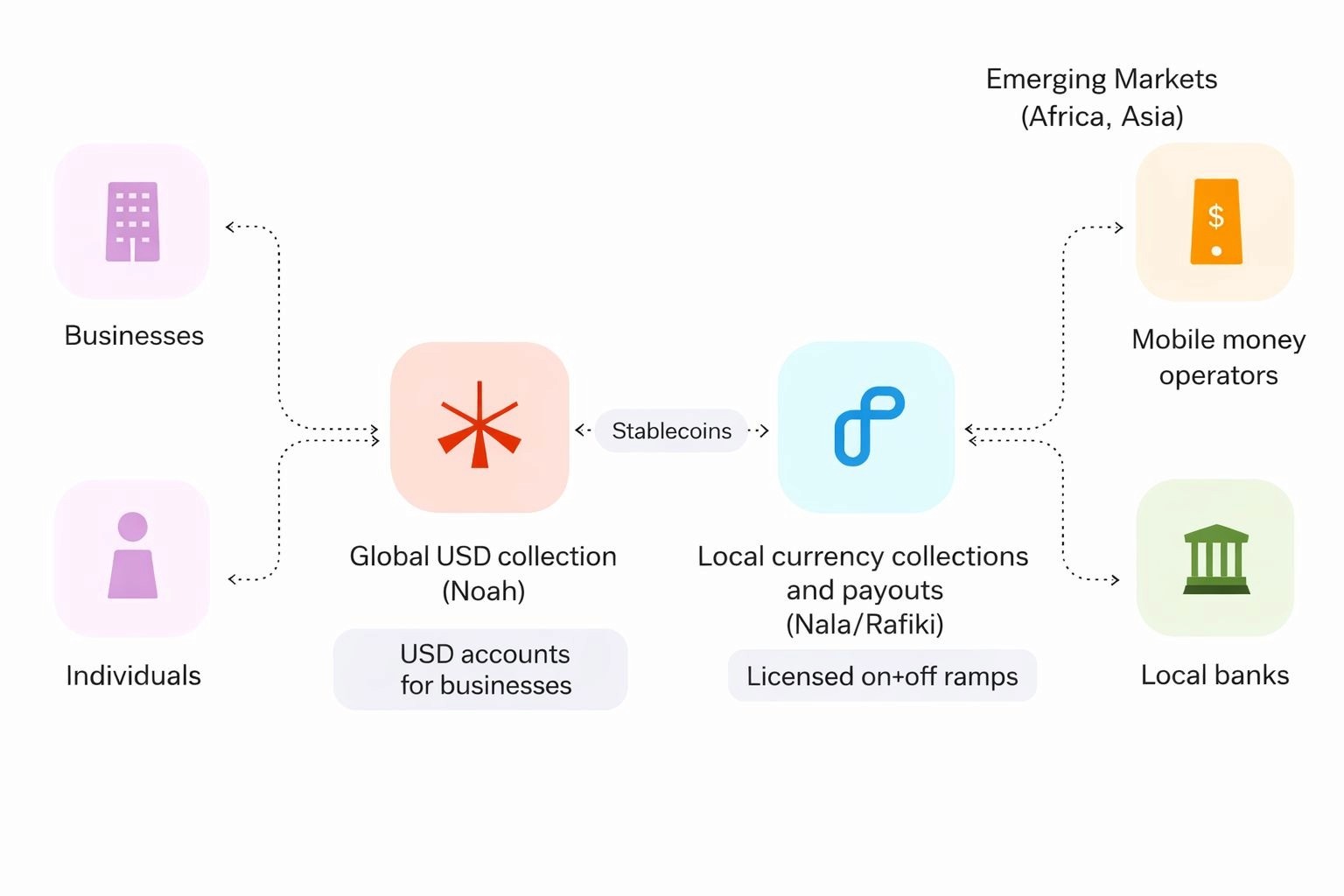

We’ve partnered with Noah, global payments infrastructure provider, to deliver the solution for emerging markets. With Noah’s global USD collection and our stablecoin on- and off-ramp network and API, we’re combining stablecoins with real, regulated infrastructure to tackle the challenges that continue to obstruct cross-border payments, such as high remittance costs.

“We didn’t build Rafiki to be another payments API. We built it to make stablecoin settlement actually work in emerging markets for payroll, payouts, treasury, and global collections. This partnership is a big step toward that future. Stablecoins aren’t the product, they’re the rail, and now they finally have the network to scale. We look forward to building the future of cross-border payments with Noah.”

Benjamin Fernandes, NALA and Rafiki CEO and Founder

We are excited to be building this new initiative to drive change in the payments industry. For many years, cryptocurrency has been regarded as an asset for asset’s sake, and we are thrilled to have found a partner that recognises stablecoins as the tool to deliver on industry promises.

Together, we’re delivering The Next Billion in fast, accessible and secure cross-border transactions.

Read more from our founder and CEO Benjamin Fernandes here.